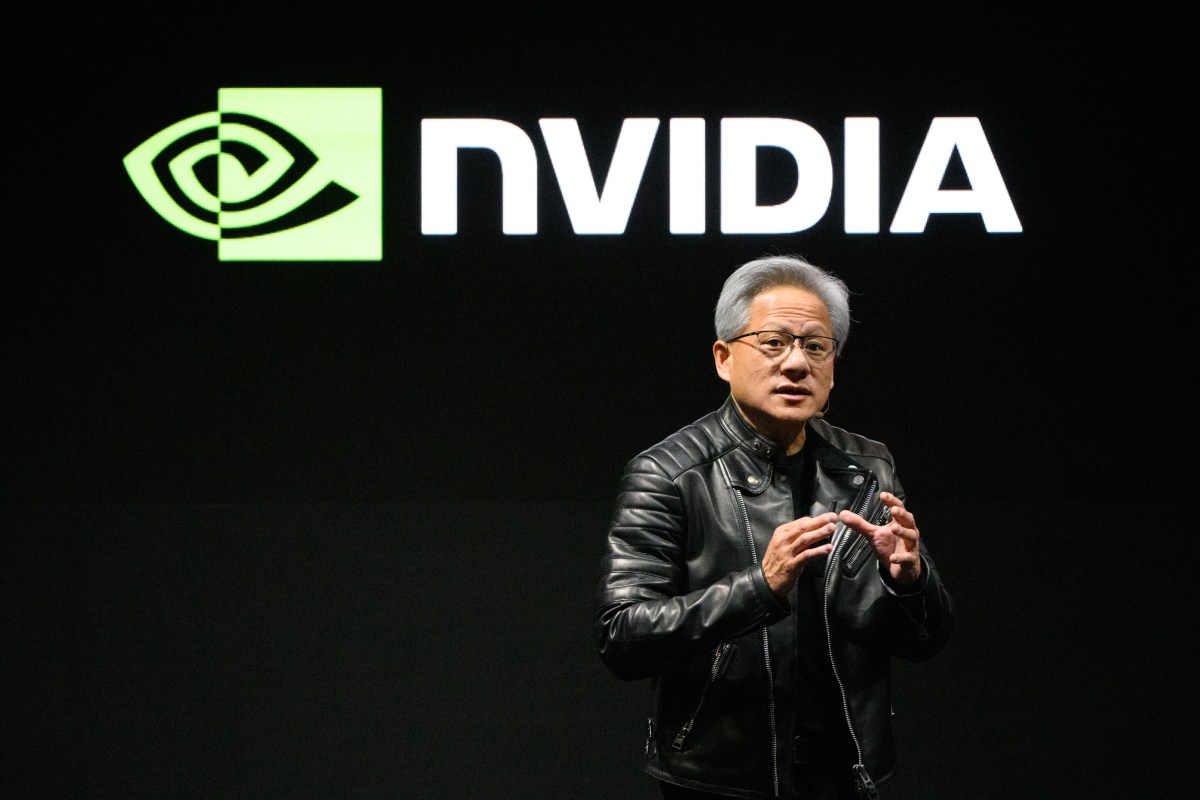

Nvidia CEO Jensen Huang argues that the market misjudged the impact of DeepSeek.

Nvidia’s Perspective on DeepSeek’s R1 Model

Jensen Huang’s Insights

Jensen Huang, the founder and CEO of Nvidia, has stated that financial markets have misinterpreted the impact of DeepSeek’s recent technological advancements, particularly concerning its R1 open-source reasoning model. During a pre-recorded interview with Alex Bouzari, CEO of DataDirect Networks, Huang shared his views that these developments could actually benefit Nvidia rather than diminish its position in the market.

Market Misinterpretation

Huang pointed out that the market’s initial reaction to the launch of the R1 model was overly pessimistic. He explained, "The market responded to R1 as if to say, ‘Oh my gosh, AI is finished.’" He emphasized that this was not the case, asserting the opposite view. According to Huang, the advancement of the R1 model provides an exciting opportunity for further growth within the AI sector. Instead of signaling that companies would no longer need computational resources, he sees it as a catalyst that will enhance the efficiency of AI models, leading to an acceleration in their adoption across various industries.

Impacts on AI Adoption

Huang elaborated that DeepSeek’s R1 has made significant strides in developing pre-trained AI models, yet it does not eliminate the necessity for post-training processes, which are still essential and inherently demanding on computational resources. He noted, “Reasoning is a fairly compute-intensive part of it,” highlighting that as AI technologies evolve, the need for robust computing solutions—like those Nvidia provides—remains critical. This suggests that the demand for Nvidia’s chips and resources won’t diminish anytime soon, but rather may increase as the need for more advanced processing grows.

Nvidia’s Stock Reaction

Nvidia experienced a significant stock price drop shortly after DeepSeek unveiled its R1 model. On January 24, Nvidia’s stock closed at $142.62; however, by January 27, it declined to $118.52, reflecting a startling loss that wiped out $600 billion from the company’s market capitalization within just three days. Huang’s comments come almost a month after this turbulence in the market.

Despite the shaky start, Nvidia’s stock has demonstrated resilience. As of the recent trading session, it opened close to $140, nearly regaining the losses incurred shortly after the R1 launch. Investors are closely watching Nvidia’s upcoming fourth-quarter earnings report set for February 26, which is expected to address both the company’s strategy in light of the AI developments and potentially the stock market’s reaction.

DeepSeek’s Open Source Initiatives

In addition to DeepSeek’s developments with the R1 model, the company has recently announced plans to open-source five code repositories as part of an “open source week” event, which adds another layer to the ongoing evolution of AI technologies. As these developments unfold, the AI landscape is likely to shift further, prompting ongoing discussions regarding the roles of established players like Nvidia and emerging technologies introduced by companies like DeepSeek.

Nvidia’s leadership continues to reassure stakeholders about the relevance of their products in a fast-evolving tech sector, and Huang’s commentary highlights a confident outlook on the future of AI and the essential role that computation will continue to play.