Microsoft Stock: Is It a Good Investment After an 18% Drop Before April 30?

On April 2, President Donald Trump revealed plans to implement a series of tariffs on imported goods from various trading partners. This announcement raised alarms about a potential global trade war and economic downturn. As a result, investors shifted their focus from stocks to safer assets, leading to a 14% decrease in the S&P 500 index. The tech-heavy Nasdaq-100 has seen a nearly 18% downturn during the same period.

Historically, the U.S. stock market has shown resilience and tends to reach new heights over time. The current market dip may present an opportunity for investors to purchase high-quality stocks at lower prices. One notable example is Microsoft (MSFT), which has maintained a successful track record for decades and is becoming a significant player in the emerging artificial intelligence (AI) sector, a field expected to be among its most lucrative ventures.

Microsoft’s stock has dropped by 18% amid the broader market sell-off. The company is set to release its financial results for its fiscal 2025 third quarter on April 30, which will shed light on its progress in AI and could potentially act as a trigger for a recovery in its stock. This raises the question: should investors consider buying Microsoft shares at a discount before the report?

Updates on Copilot

Microsoft has invested approximately $14 billion in OpenAI since 2016, the creator of the popular ChatGPT chatbot. The latest models from OpenAI have enabled Microsoft to develop its own AI virtual assistant named Copilot, which has been integrated for free into its widely used software such as the Windows operating system, Bing search engine, and Edge web browser.

Copilot is also offered as a paid add-on for subscribers of the 365 productivity suite, which includes applications like Word, Excel, PowerPoint, and Outlook. Microsoft reports that more than 400 million 365 licenses are purchased by businesses worldwide, and with Copilot costing around $30 per license each month, it has the potential to generate significant recurring revenue in the long term.

Usage of Copilot surged 60% in the fiscal 2025 second quarter compared to the previous quarter. Furthermore, businesses that adopted Copilot when it first became available 18 months ago have expanded their licenses by tenfold.

Microsoft also introduced Copilot Studio, enabling businesses to create tailored AI agents. These agents can perform a variety of tasks, such as taking notes in meetings and answering customer inquiries on company websites. In Q2, clients created over 400,000 unique agents, demonstrating a twofold increase from the prior quarter. Demand for Copilot continues to rise across different sectors, and investors should anticipate further updates on April 30.

The Role of Azure in AI Strategy

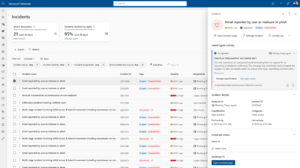

While Copilot shows promise, the Azure cloud platform is central to Microsoft’s AI strategy. Azure features modern data centers filled with advanced chips from top manufacturers like Nvidia. It offers businesses computing power needed to develop and deploy AI applications.

Companies can access a variety of pre-existing large language models (LLMs) through Azure, including those from OpenAI, to help fast-track their own AI developments.

Azure is one of the fastest-growing segments of Microsoft’s business. In the latest quarterly results, Azure AI revenue increased by an impressive 157% year over year, contributing 13 percentage points to Azure’s overall growth rate of 31%. Therefore, Azure AI will be a key focus area when Microsoft releases its results for Q3 on April 30.

Investors will also be monitoring Microsoft’s capital expenditures closely. The company plans to invest over $80 billion in AI data center infrastructure and chips in fiscal 2025. However, disruptions in global trade due to tariffs and other economic factors could lead Microsoft to adjust its spending, which might affect Azure AI’s growth, especially since demand for more computing capacity currently exceeds supply.

Buying Microsoft Stock Before April 30?

The recent 18% decline in Microsoft stock has created an attractive buying opportunity. The stock is now trading at a price-to-earnings (P/E) ratio of 29.6, which is 11% lower than its five-year average of 33.2.

Given Microsoft’s strong historical performance, purchasing shares now could be wise, regardless of the impending earnings report. A single quarter’s results are unlikely to change the company’s long-term outlook, and the recent drop could be a solid entry point for long-term investors.

According to PwC, AI could contribute an estimated $15.7 trillion to the global economy by 2030. As Microsoft continues to be a leader in this sector, holding its shares could be a profitable decision over the next several years.

Moreover, Microsoft might be better positioned to navigate the recent trade tensions compared to many companies, as it primarily offers software and digital services. Tariffs usually target physical goods, so Microsoft’s core offerings have largely escaped direct penalties. However, an economic slowdown could have indirect effects on demand for its services, yet these impacts are likely to be temporary, with countries currently engaging in trade discussions with the U.S.