Promising Leader in AI, IoT, and Automotive Sectors

Qualcomm’s Q1 Fiscal 2025 Results: A Mixed Bag

Qualcomm recently released its financial results for the first quarter of fiscal 2025, revealing solid performance that, surprisingly, led to a drop in its stock price after hours. While the results exceeded estimates, lower guidance and significant news from Apple have raised concerns about Qualcomm’s future business prospects. Additionally, market volatility, especially related to political factors, has compounded these issues, leading to an approximately 11.6% decrease in Qualcomm’s share prices since the beginning of the year, compared to a 15.5% decline in the broader NASDAQ.

Market Conditions and Volatility

The stock market has been influenced by numerous factors lately, especially political events tied to former President Trump, causing unpredictable fluctuations across many sectors. For Qualcomm, specific impacts stemmed from what many refer to as the “DeepSeek sell-off” and the popping of the AI bubble earlier this year. These occurrences have not only affected Qualcomm but have left many investors cautious.

Qualcomm’s Business Overview

Despite this downturn, Qualcomm continues to be a leader in the wireless technology space, providing essential chips, software, and services. Historically, Qualcomm gained recognition through its critical contributions to the mobile phone market. As this industry matures, the focus has shifted toward the Internet of Things (IoT), representing a significant growth opportunity for the company.

Diversification Strategies

Qualcomm has proactively moved beyond merely catering to handset manufacturing. The company is increasingly investing in automotive technologies and IoT solutions, which are poised for rapid expansion. While smartphones still account for the majority of Qualcomm’s revenue, the company has managed to reduce this from around 80% to 75% of its total sales, a shift that analysts view positively amidst declining handset revenue.

Future Growth Areas

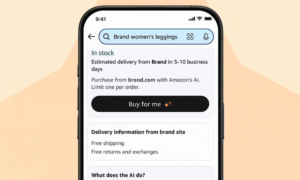

One of Qualcomm’s strategic moves is its dedication to AI inferencing, especially for edge computing applications. The company believes that performing AI calculations directly on devices is more efficient and secure than relying on cloud computing. This approach potentially improves device privacy, ensuring data remains on the device rather than being transmitted back and forth to the cloud.

Edge Computing and IoT Market Growth

Qualcomm has already launched its QCT Industrial IoT product line aimed at enhancing edge computing capabilities. Their new X85 modem, introduced in March 2025, incorporates an advanced 5G AI processor, promising superior performance for high-demand AI tasks. The company anticipates the edge-computing market will grow to an estimated $900 billion by 2030, a goal supported by third-party market research forecasts, indicating significant growth in the sector.

Automotive Sector Expansion

The automotive market is another promising frontier for Qualcomm, with AI technology increasingly becoming integral to automotive advancements. Studies suggest that the automotive AI market will see compound annual growth rates (CAGR) around 42%, expanding from $4.8 billion in 2024 to an impressive $186.4 billion by 2034. Qualcomm’s push into automotive technology has already begun to yield results, with their automotive revenue rising significantly over the past year.

Preparing for Apple’s Transition

A significant concern for Qualcomm is Apple’s plan to transition away from using Qualcomm’s modem chips. Although this change is expected to occur gradually, with a complete switch by 2027, Qualcomm has taken steps to mitigate this risk. The company is forecasting growth in other areas, such as IoT and automotive, which could dampen the impact of losing Apple as a future client.

Financial Metrics and Performance Outlook

Looking at Qualcomm’s financial performance, projections indicate that total revenue could grow by approximately 15% for fiscal 2025. While future growth might slow with the potential loss of Apple’s business, Qualcomm’s investments in new markets provide a solid foundation for continued revenue increases. Management anticipates that the automotive and IoT sectors could collectively generate about $22 billion by fiscal year 2029.

Profitability and Margins

Qualcomm is currently experiencing strong profitability, as evidenced by its gross profit margin, which stands at 55.99%. With a solid EBITDA margin of approximately 30.92%, the company is well-positioned to sustain its financial health. Analysts also foresee potential margin expansion as shifts occur from lower-margin to higher-margin segments.

Geopolitical Considerations

An additional risk for Qualcomm arises from its considerable exposure to the Asian market, particularly China, which accounts for over 62% of its revenue. Ongoing tensions related to trade policies, such as tariff considerations, could adversely affect Qualcomm. However, the direct implications may be mitigated in the near term as the company diversifies its revenue streams away from handset manufacturing.

Valuation

Despite recent stock price drops, Qualcomm’s current valuation appears attractive compared to its industry peers. With a forward price-to-earnings (P/E) ratio of 11.2, significantly lower than the industry average, many analysts see this as an opportunity for growth. Should the market correct over time, a re-rating towards a more standard P/E could imply a substantial increase in stock value.

Qualcomm’s ability to evolve amidst market challenges, embrace new technologies, and diversify its business model renders it a company to watch in the coming years.