Nvidia Shares Surge as Chip Sector Gains Momentum Following AI Investment Announcements from Meta and Microsoft

Nvidia Stock Gains Driven by AI Investments

Overview of Recent Stock Movement

Nvidia’s (NVDA) stock surged by approximately 4.9% in premarket trading on a Thursday morning, showcasing a strong performance among semiconductor stocks. This increase can be largely attributed to positive earnings reports from tech giants Meta (META) and Microsoft (MSFT), both of which emphasized their ongoing commitment to investing in artificial intelligence (AI).

Impact on AI Chipmakers

Other key players in the AI chip manufacturing sector also witnessed gains. Advanced Micro Devices (AMD) saw an increase of 2.6%, while Broadcom (AVGO) rose by 2.8%. Additionally, Micron Technology (MU), a significant supplier of memory chips for Nvidia’s GPUs, experienced a 2.9% increase in premarket trading.

Earnings Reports and Investment Plans

The stock uplift largely follows the earnings announcements from Microsoft and Meta on the prior Wednesday. Microsoft reaffirmed its ambitious $80 billion strategy for expanding AI data centers, with more than half of this investment directed towards projects in the United States. Meanwhile, Meta raised its capital expenditure forecast for 2025 from the previous range of $60-$65 billion to a new range of $64-$72 billion. This revised outlook reflects Meta’s intention to invest further in AI infrastructure and address the rising costs associated with hardware.

Statements from Executives

Meta’s Chief Financial Officer, Susan Li, remarked, “This updated outlook reflects additional investments to support our AI efforts.” Microsoft’s CFO, Amy Hood, expressed a strong commitment to capital expenditure, saying, “We remain committed to investing against the strong demand signals we see for our services.”

Investor Sentiment and AI Impact

Investors had been on edge regarding possible cutbacks in AI investments from Microsoft, especially considering reports of the cancellation of certain data center projects. Microsoft and Meta are significant clients for Nvidia, with projected contributions of around $20 billion and $9 billion to Nvidia’s revenue in 2024, respectively.

Big Tech’s Financial Commitment to AI

Collectively, major tech companies, referred to as the "hyperscalers," are set to invest over $330 billion this year in AI and related infrastructure. This includes not only Microsoft and Meta but also Google (GOOG) and Amazon (AMZN). However, these substantial investments have faced scrutiny from investors who are eager to see tangible returns from AI technology.

Specific Financial Performance

Meta announced that 30% more advertisers are utilizing its AI tools, and its AI platform boasts nearly 1 billion monthly active users. Despite beating earnings expectations, Meta did not clarify the specific financial impact of AI on these results.

In a more tangible example, Microsoft’s Intelligent Cloud segment, which encompasses its AI services, reported a substantial revenue increase of 21% year-over-year, approaching $27 billion. The Azure cloud services segment grew by 35% from the previous year, with AI accounting for a notable 16 percentage points of this growth. However, this revenue still falls short of matching Microsoft’s extensive investments in its AI initiatives.

Market Reactions and Stock Trends

After these announcements, both Meta and Microsoft stocks saw significant premarket increases, with Meta climbing by 6.5% and Microsoft jumping 9%. Despite Nvidia’s recent gains, its year-to-date performance remains down by roughly 19% as of the previous trading day, which is considerably worse than the S&P 500’s drop of 5%.

Challenges Ahead for Nvidia

Nvidia’s stock performance comes against a backdrop of increased scrutiny from analysts, including a recent Sell rating from Seaport, citing that the potential benefits of AI have already been factored into stock prices. The company has also faced challenges from the regulatory environment, especially regarding its international operations. Recent restrictive trade policies proposed by the Trump administration could impact its position in the competitive global market.

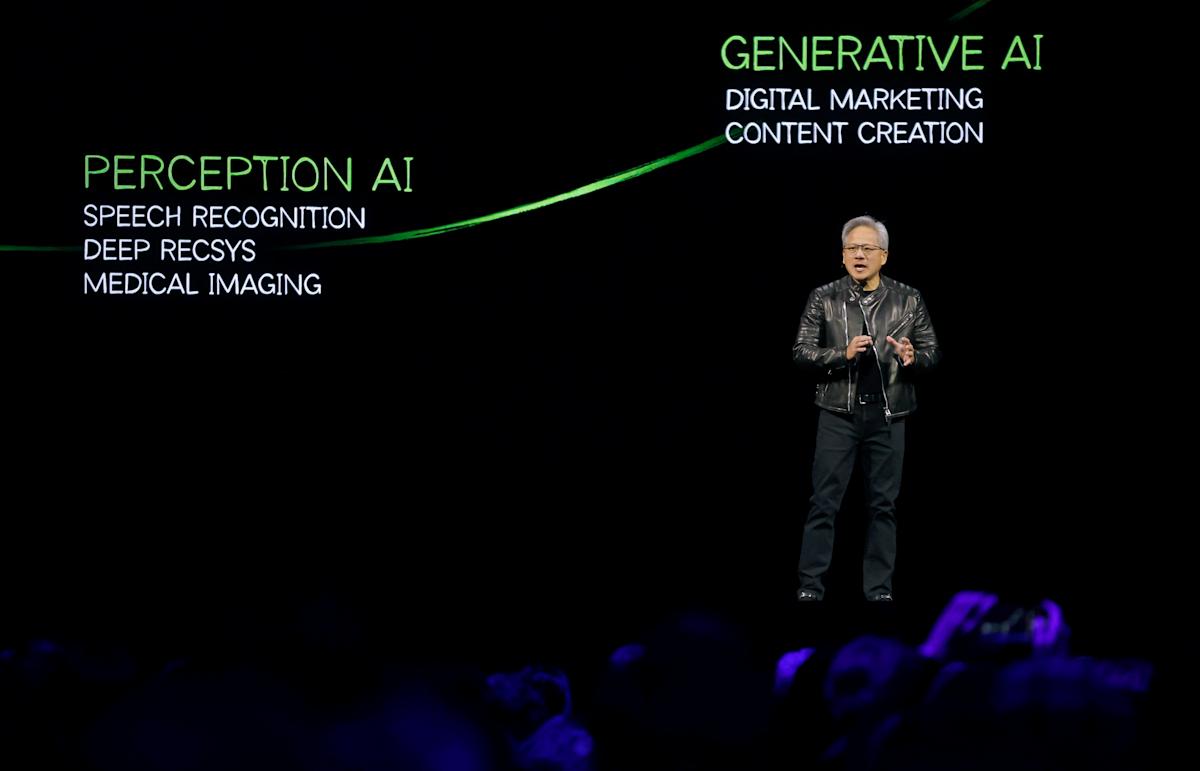

In a recent visit to Washington, D.C., Nvidia CEO Jensen Huang encouraged the administration to support the global spread of American AI technology, reflecting the urgency of the matter in a rapidly evolving technological landscape.

On a closing note, Nvidia continues to navigate dynamic market conditions, facing both opportunities and challenges amid its ambitious growth trajectory in the AI sector.