AI Agents are Poised to Revolutionize Decentralized Finance

Understanding AI Agents in Web3

AI agents have become a prominent subject in the Web3 community, leading to ambitious visions in the crypto space. The core idea revolves around intelligent, autonomous entities that can manage assets, strategies, and risks through decentralized protocols. Proponents believe these systems not only perform tasks more effectively than humans but also relieve users from continuous oversight of their digital resources.

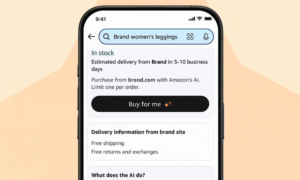

As excitement grew, predictions surfaced, claiming that “within one year, the majority of all DeFi total value locked (TVL) will be managed by AI agents.” However, as time passes, the initial thrill is being tempered by the reality of the existing landscape. Currently, the most recognized AI agents are often tied to social media profiles and tokens, rather than the more groundbreaking concept of DeFi-native agents. The current state of the AI economy appears to be awaiting developments that align with its ambitious narratives.

The Current State of AI Agents

The term “AI agent” has evolved and can mean many things, but its integration into blockchain technology has generated heightened expectations. In recent months, it has become evident that while the partnership of AI Agents and Web3 offers immense potential, the sector must progress beyond early-stage speculation to create long-term value for users.

Projects like Fetch noted in late 2023 that “agent-based systems present a remarkable opportunity for companies and individuals alike.” Although the use cases initially were limited, the ongoing research showcases how AI agents can reshape value creation and distribution in decentralized systems.

Types of AI Agents

Several foundational projects, including Giza, Axal, and Theoriq, are laying the groundwork for dedicated infrastructure for AI agents in DeFi, each with a unique approach.

- Giza: Focuses on verifiable on-chain inference utilizing zero-knowledge machine learning, allowing agents to operate with cryptographic accountability.

- Axal: Emphasizes execution integrity, creating systems for runtime verification and enforcement of constraints.

- Theoriq: Explores decentralized intelligence through AI swarms, enabling agents to collaborate within shared environments.

This diversity is crucial in addressing challenges such as the fragmentation of AI agents in DeFi. Currently, many agents manage token swaps, yield strategies, or cross-chain transactions independently, resulting in a fragmented user experience. The proposed solution, known as Agentic DeFi, aims for intelligent agent swarms that can work together across various tasks and blockchains to provide a seamless experience.

Theoriq’s AI swarm model signifies a promising direction for creating synchronized agent ecosystems that function cohesively rather than in isolation. While these initiatives are ambitious, they are still in the early phases. Some projects, like Giza, are already showing signs of a successful product-market fit.

The Intelligence and Infrastructure Dilemma

A shared viewpoint among experts is that the main barrier isn’t the intelligence of AI agents but rather the infrastructure they operate within. For these agents to function effectively in DeFi, they need to integrate into modular environments allowing safe execution, intelligent adaptation, and adherence to human-defined constraints.

According to recent analyses, “without blockchain’s inherent transparency and security, there is no trusted foundation on which AI agents can establish reliable interactions.” Hence, robust structures, including vault frameworks, risk engines, and liquidity systems, are necessary. These systems help define how AI agents handle capital and assess risks, ensuring a safe operating environment.

The Future of DeFi-Ready AI Agents

Envisioning a future where AI agents manage vaults, rebalance portfolios, and engage in governance is becoming more tangible. However, achieving this vision requires more than superficial integrations or overhyped retail bots. True progress hinges on establishing comprehensive DeFi frameworks, effective risk controls, and adaptable liquidity management tools.

In this evolving landscape, the unique methodologies being utilized by different AI agents are vital. The elements provided by Giza, Axal, and Theoriq are not in competition; instead, they complement one another, collectively sculpting a promising future for AI agents in the decentralized finance sector.