Choosing the Superior AI Stock: Alphabet or Nvidia?

Investing in AI: A Look at Alphabet and Nvidia

Overview of Tech Giants in AI

Tech companies like Alphabet (NASDAQ: GOOG, GOOGL) and Nvidia (NASDAQ: NVDA) are leading the charge in the field of artificial intelligence (AI). They present unique opportunities for investment as they contribute significantly to the evolving AI landscape.

Nvidia: Leading AI Hardware Provider

Nvidia stands out as a key player in the semiconductor industry, providing the hardware essential for AI operations, particularly within cloud computing environments. Major tech firms, including Alphabet through its Google Cloud platform, rely on Nvidia’s capabilities to enhance their AI potentials.

Recent Performance

Nvidia has experienced remarkable growth, reporting a 114% increase in sales to $130.5 billion in its fiscal year ending January 26. A substantial part of this growth can be attributed to tech companies, including Alphabet, investing in Nvidia’s products for their AI infrastructure. Looking forward, Nvidia anticipates sales of $43 billion in the first quarter of its fiscal year 2026, a significant jump from the previous year’s $26 billion.

Alphabet: Software and AI Services

In contrast to Nvidia’s hardware focus, Alphabet emphasizes software-driven AI solutions. The company has invested heavily in AI, pouring $52.5 billion into capital expenditures last year, with plans to increase that to $75 billion by 2025.

Navigating AI Evolution

As consumer preferences shift from traditional search engines to AI tools like OpenAI’s ChatGPT, Alphabet must adapt swiftly. A report from research firm Gartner predicts that the usage of search engines could decline by 25% by 2026 as people gravitate towards AI applications. In 2025, Google accounted for $198.1 billion of Alphabet’s total expected revenue of $350 billion, underscoring the importance of AI to Alphabet’s future profitability.

Financial Performance: Comparing Alphabet and Nvidia

Both companies showcase strong financial health, making the investment choice more challenging for potential investors.

Revenue and Income

Alphabet reported a 14% year-over-year increase in revenue for 2024, totaling $350 billion. This resulted in a net income of $100.1 billion and a free cash flow (FCF) of $24.8 billion. On the other hand, Nvidia’s remarkable sales boost for the same period led to a net income of $72.9 billion and an FCF of $60.7 billion.

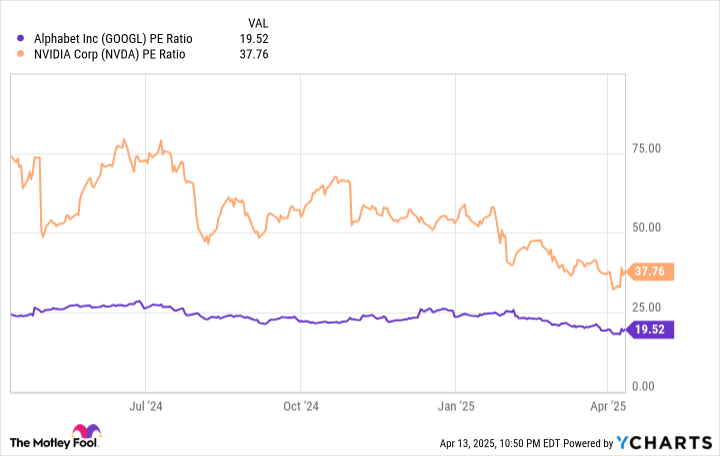

Price-to-Earnings Ratio

When it comes to stock valuation, one metric to consider is the price-to-earnings (P/E) ratio, which assesses how much investors are willing to pay per dollar of earnings. Nvidia’s current P/E ratio stands at 37.8, which, despite a recent decline in its share price, is significantly higher than Alphabet’s 19.5. Consequently, Alphabet appears to offer better value for new investors.

Future Innovations and Strategies

Both Alphabet and Nvidia are strategically looking towards future technologies like quantum computing, which can enhance their AI capabilities.

Alphabet’s Quantum Initiatives

Alphabet recently announced its development of Willow, a quantum chip capable of performing computations exponentially faster than today’s supercomputers. While this technology is still in the experimental phase, its successful implementation could transform the landscape of AI.

Nvidia’s Computational Advancements

Nvidia is also positioning itself for long-term growth with its new Blackwell Ultra platform. Set to launch later this year, this platform promises to deliver the enhanced computing power needed for the next era of AI, focusing on post-training refinement where AI models will better mimic human reasoning.

Making the Investment Decision

Investors considering between Alphabet and Nvidia should factor in their respective roles within the AI sector. Nvidia is seen as a promising option due to its leading position in semiconductor production, while Alphabet’s robust software offerings and substantial investments in AI present compelling reasons to consider its stock as well.

Ultimately, potential investors should continuously monitor the developments within both companies, especially regarding how AI will influence consumer behavior and revenue streams as the market continues to evolve.