DeepSeek Highlights That U.S.-China Tech Competition Requires More Than Just Technology Sanctions

U.S.-China Tech Competition: Dynamics and Strategies

Understanding the Competitive Landscape

The technological rivalry between the United States and China is intensifying, leading Washington to reassess its strategies for maintaining technological superiority. Rather than merely trying to protect existing advantages, there is a growing realization that establishing a lead in emerging technologies is crucial. Presently, the U.S. strategy focuses on hindering its competitors through stronger export controls and efforts to prevent the transfer of critical technologies to rival nations. However, as supply chains become more intricate and varied, the likelihood of circumvention through third-party intermediaries increases, complicating enforcement efforts.

Recent Actions Against China

Since 2018, both the Trump and Biden administrations have implemented extensive restrictions targeting China. Key actions have included placing several Chinese firms, such as Huawei and SMIC, on the Commerce Department’s "entity list," which limits their access to American technologies. Export controls on semiconductors were significantly tightened in October 2022 and again in October 2023 when advanced chips, essential for AI applications, were banned from being exported to China.

On January 15, 2017, shortly before Donald Trump’s inauguration, the U.S. Department of Commerce introduced new export rules focused on advanced computing semiconductors, further bolstering restrictions against companies in China and Singapore.

The Challenge of Bypassing Export Controls

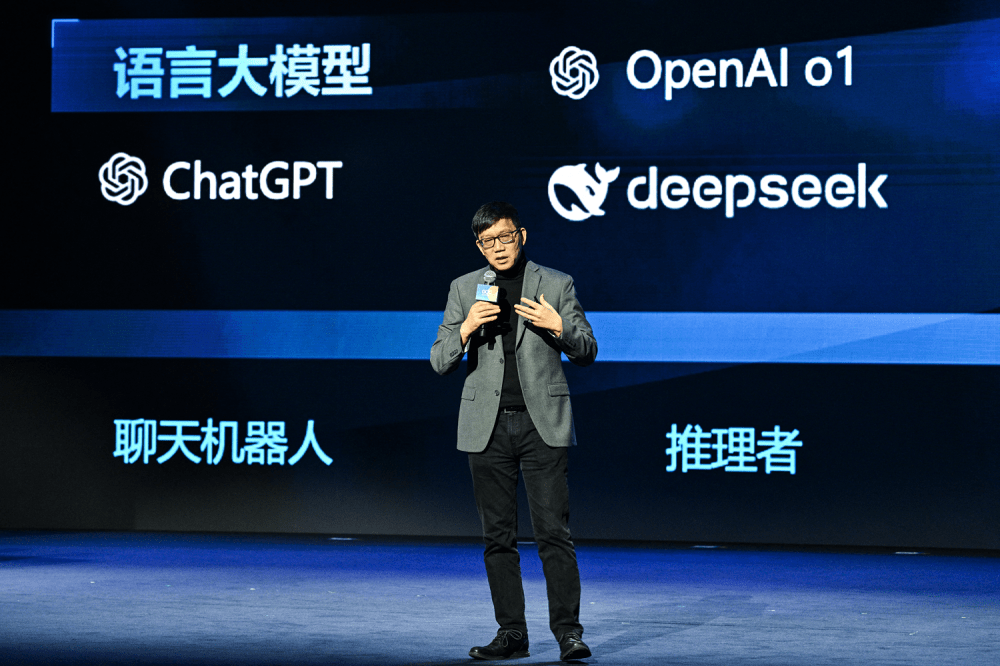

The recent achievements of Chinese AI firm DeepSeek have raised alarms among U.S. lawmakers, prompting calls for a review of export controls on semiconductors. DeepSeek reportedly utilized Nvidia’s H800 chip, which was altered to comply with U.S. export restrictions. U.S. officials have begun investigating whether DeepSeek acquired these chips through intermediaries in Singapore.

Reports by firms like SemiAnalysis suggest that DeepSeek invested significantly in Nvidia chips, raising questions about how effectively U.S. export laws can restrict China’s AI development. DeepSeek has amassed a substantial amount of computing power, indicating potential implications for global AI development.

The Role of Third-Party Countries

Third-party nations are central to the evolving landscape of U.S.-China tech competition. Reports indicate that Chinese companies have been procuring restricted chips via re-export hubs such as Singapore and the United Arab Emirates. This has heightened concerns about the efficacy of U.S. export controls, particularly as countries like Taiwan are perceived to have weaker restrictions that could facilitate smuggling.

Additionally, informal markets reportedly exist to exploit gaps in supply chains, allowing Chinese companies to stockpile essential chips before U.S. bans come into force. Significant firms like Huawei have stockpiled chips in anticipation of tighter restrictions.

China’s Domestic Strategies

Despite external pressures from export controls, China is working to achieve technological independence, a key aim articulated in its "Made in China 2025" initiative. Through state support, companies such as Huawei and others are advancing their semiconductor technologies, though there may still be limitations in performance compared to global competitors. Initiatives focusing on older-generation chips are also a part of their strategy, which could raise challenges for other regions, particularly within the European Union.

China has also issued its own warnings; threats of economic retaliation against countries initiating restrictive measures on chip exports indicate its resolve to protect its interests in this domain.

The Coordinating Role of Other Nations

Countries such as Singapore and India are navigating these complex geopolitical waters. Singapore acts as a significant trade hub due to its neutrality, playing a crucial role in the semiconductor supply chain. Meanwhile, India is positioning itself as a competitive player in the technology landscape through design and software development, with ambitious goals for growth in the semiconductor sector.

India aims to develop foundational AI models that could bolster its capabilities in varied sectors, including agriculture and climate change. The country is also increasingly investing in GPU infrastructure to support AI developments.

Building Cooperation and Innovation

Instead of viewing third-party nations as undermining its efforts, the U.S. could strengthen ties with them for mutual benefits. Collaborating with countries like Singapore on AI regulations and cybersecurity, alongside investing in their tech sectors, could enhance the U.S.’s position in the global arena.

The U.S. needs to focus on boosting its domestic innovation ecosystem, complemented by strong partnerships within the tech community. This requires increased investment in research and development and fostering a pipeline of skilled workers through education policies.

Efforts to maintain and enhance U.S. leadership in key technological sectors must balance strategic interests with collaboration opportunities, as the competition against China continues to evolve and intensify.