Google’s Boldest AI Initiative: An Overview of Gemini 2.5 and AI Developments

Alphabet’s Earnings Report: A Closer Look

Overview of Earnings

Alphabet, the parent company of Google, recently released its first-quarter earnings for the year, surpassing analyst forecasts. They reported a revenue increase of 12%, totaling $90.2 billion, along with a 46% rise in net income, which amounted to $34.5 billion. This impressive performance has led to a boost in their stock price, which saw a 5.1% rise in after-hours trading.

Key Financial Highlights

- Earnings per Share: Alphabet recorded earnings of $2.81 per share compared to estimates of $2.01 per share.

- Revenue Growth: The company’s core search division grew nearly 10%, while Google Cloud experienced a substantial sales increase of 28%.

- Total Revenue: Alphabet generated $90.2 billion in revenue, up from $80.6 billion in the same quarter last year.

Artificial Intelligence Initiatives

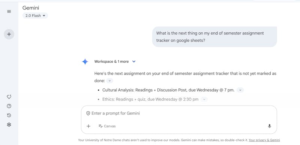

Sundar Pichai, the CEO of Alphabet, emphasized the company’s significant advancements in artificial intelligence (AI). A standout is the Gemini 2.5 model, which is now recognized as one of the best in the industry. The integration of AI technologies across various Google products has led to remarkable user engagement, with the AI Overviews feature attracting 1.5 billion monthly users.

- AI Features:

- AI Overviews are becoming essential to search functionality.

- An experimental AI Mode has been introduced for more complex queries, leading to longer queries compared to traditional search methods.

Growing Investment in Infrastructure

Alphabet continues to invest heavily in its infrastructure:

- CapEx Investments: The first quarter saw capital expenditures totaling $17.2 billion, primarily for servers and data centers.

- Future Plans: The company plans to significantly increase its yearly investment to about $75 billion. However, this may affect their financial outlook due to increased depreciation costs.

Waymo’s Progress

Waymo, Alphabet’s autonomous vehicle subsidiary, is making notable strides in service delivery. It has expanded operations to provide over 250,000 paid passenger trips weekly—a fivefold increase from last year.

- Future Plans for Vehicles: One potential plan includes selling Waymo vehicles directly to consumers, with Pichai mentioning the possibility of personal ownership in the future.

Market Challenges

Despite its strong performance, Alphabet is not immune to external challenges:

- Macroeconomic Influences: The company acknowledged concerns regarding changes in international trade regulations, specifically the recent closing of the “de minimis” loophole that previously exempted certain imports from duties.

- Advertising Market: Analysts from Bank of America have raised concerns about potential softness in advertising spend in the upcoming quarters. They note that while Google Search ad spending may remain resilient, uncertainties linger due to increased competition and external market factors.

Categories of Revenue

The breakdown of revenue sources illustrates a diverse portfolio:

- Search Revenue: Increased by 10% to $50.7 billion, driven by sectors like financial services and retail.

- YouTube Advertising Revenue: Also saw growth of 10%, amounting to $8.9 billion, primarily fueled by direct response advertising.

- Subscription Services: Revenue rose by 19% to reach $10.4 billion, with Google One and YouTube subscriptions leading the charge.

- Google Cloud: Emerged as a strong performer with $12.3 billion in revenue, reflecting a 28% increase from the previous year.

Legal Challenges

Alphabet continues to navigate significant legal challenges surrounding antitrust regulations:

- Ongoing Lawsuits: The company is facing several antitrust lawsuits from the U.S. government over claims of monopolistic behavior in online advertising and search services. Although these issues were not a major focus during the earnings call, they remain a pertinent part of Alphabet’s operational landscape.

As Alphabet navigates a competitive and ever-evolving technology landscape, its latest earnings report reflects a combination of robust growth, critical investment in AI and infrastructure, and the challenges presented by market dynamics and regulatory scrutiny.