Meta Stock Confronts Significant Legal Challenge Impacting Its AI and Platform Prospects

Meta, the parent company of popular platforms like Facebook, Instagram, WhatsApp, and Messenger, is facing a significant legal challenge that could impact its entire operation and slow down its advancements in artificial intelligence (AI). The United States Federal Trade Commission (FTC) has brought a lawsuit against Meta, alleging that it has employed a “buy-or-bury” tactic. This means that, instead of competing in the market, Meta has reportedly been acquiring potential competitors such as Instagram and WhatsApp. This legal action, which began in 2021, has now reached the trial phase, and a ruling in favor of the FTC could compel Meta to dismantle its various platforms.

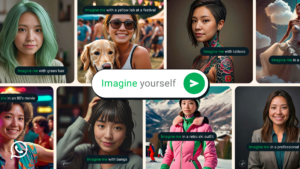

AI Ambitions Hindered by Data Access

Meta’s capacity to develop its AI models, particularly the Llama AI series, relies heavily on the vast amounts of user data collected from its platforms. If Meta loses access to this aggregated data, it stands to lose a crucial edge in the competitive AI landscape. The ability to integrate data from Facebook, Instagram, and WhatsApp is central to maintaining the effectiveness of its AI training processes.

In a courtroom appearance on April 14, CEO Mark Zuckerberg defended Meta’s position. He pointed out that social media usage has evolved, stating,

“People just kept on engaging with more and more stuff that wasn’t what their friends were doing.”

Meta contends that the FTC’s perspective does not accurately reflect the current competitive environment, especially with platforms like TikTok and YouTube gaining traction.

However, some experts challenge this viewpoint. Jasmine Enberg from eMarketer mentioned in a report for the Los Angeles Times that “Instagram has been picking up the slack for Facebook for a long time,” asserting that losing Instagram could significantly diminish Meta’s attractiveness, particularly among younger audiences.

If the court mandates that Meta separate its various applications, it may face limitations in accessing combined user data that fuels its AI initiatives. Attorney Andrew Rossow indicated that in such a scenario, different platforms would manage their own user data, likely leading Meta to negotiate new agreements for data sharing that would be closely regulated.

Other Challenges Facing Meta

Meta’s troubles do not end with the ongoing FTC lawsuit. The company had previously halted its AI initiatives in the European Union due to data protection regulations. Moreover, recent court filings revealed that Meta may have resorted to using unauthorized books from LibGen to train its AI models, marking a questionable approach as it strives to compete with companies like OpenAI.

With these developments, Meta faces more than just the prospect of parting with its platforms; it risks being cut off from critical data that underpins its AI advancements. Such a scenario could significantly impede the progress of its Llama models and overall AI efforts.

In light of these legal pressures, analysts remain optimistic about Meta’s stock performance. The company currently holds a Strong Buy rating based on 42 Buy recommendations, three Hold ratings, and only one Sell rating. The average target price is set at $716.56, suggesting a potential upside of 43% from current valuation levels. Market experts believe that while Meta is navigating through a turbulent period, the outcome of the court case could dramatically alter its trajectory.