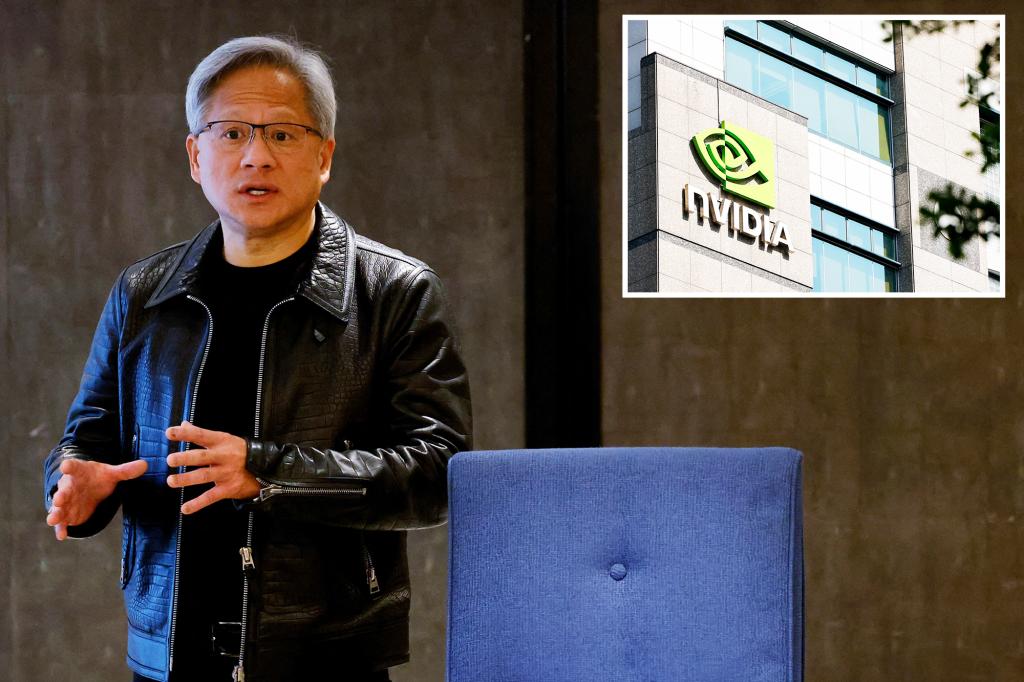

Nvidia CEO Visits China Amid Investigation into Potential Chip Sale Rule Violations

Jensen Huang’s Visit to Beijing: Key Meetings and Implications

Nvidia’s CEO, Jensen Huang, recently made headlines following an unexpected trip to Beijing. This surprising visit occurred just a day after a House committee announced an investigation aimed at determining whether Nvidia violated stringent export regulations by selling its products to China.

Meetings with Key Players

During his trip, Huang met with Liang Wenfeng, the founder of DeepSeek, a Chinese AI company. The discussion reportedly revolved around innovative chip designs tailored for Chinese clients, as reported by the Financial Times, with sources familiar with Huang’s schedule confirming these details. In addition to his meeting with Liang, Huang also engaged in discussions with China’s Vice Premier He Lifeng and other high-ranking trade officials.

Importance of the Chinese Market

Huang emphasized the significance of the Chinese market for Nvidia’s continued success. As reported by the Chinese state broadcaster CCTV, he stated, “We hope to continue to cooperate with China.” The media coverage surrounding Huang’s meetings has been extensive, indicating that Nvidia recognizes the critical role of China in its overall business strategy.

U.S. Legislative Concerns

The timing of Huang’s Beijing visit raises alarms among U.S. lawmakers who are already anxious about the potential of Nvidia’s advanced chips aiding companies like DeepSeek in catching up to the U.S. within the AI sector. The House Select Committee on China is currently investigating Nvidia’s sales to Asia, particularly regarding compliance with U.S. export restrictions. The committee has labeled DeepSeek as a "profound threat" to national security, claiming that the firm utilizes thousands of Nvidia chips that are banned from being exported to the People’s Republic of China.

Financial Impact on Nvidia

Following Huang’s meetings, Nvidia’s stock price fell by more than 3%. The company’s shares have already declined approximately 25% since the beginning of the year, reflecting broader market fluctuations linked to former President Trump’s tariffs on Chinese goods. Experts, including notable figures like David Sacks, a former AI adviser during the Trump administration, and Elon Musk, have questioned DeepSeek’s assertion that it trained its AI model for less than $6 million without access to Nvidia’s cutting-edge chips.

Regulatory Developments

Earlier in the week, the Trump administration took decisive action by implementing restrictions on the sale of Nvidia’s H20 computer chips to China. This move was particularly surprising, as the H20 chip was designed to circumvent existing U.S. export controls on more sophisticated models. In light of these new regulations, Nvidia has projected a potential financial setback of $5.5 billion.

Broader Context: U.S.-China Trade Relations

Nvidia’s increasing scrutiny comes amid a growing trade war between the U.S. and China. Since the onset of tariffs, the U.S. has enforced a cumulative 145% tariff on imports from China, leading to retaliatory measures from Beijing, which has applied a 125% tariff on U.S. goods. This tumultuous economic environment has heightened the stakes for major companies like Nvidia, which operate at the intersection of technology and international trade.

As the investigation continues and trade relations evolve, the implications for Nvidia and its strategic partnerships in China remain uncertain. The complexities surrounding export controls and national security concerns underline the significant challenges that U.S. tech companies are facing in the international arena.