Nvidia Reports Robust AI Chip Sales Amid DeepSeek Concerns

Nvidia’s Resilience in the AI Boom

Nvidia, a leading chip manufacturer, plays a vital role in the thriving artificial intelligence (AI) sector. Recently, the company reported strong business performance, contrary to concerns about a potential market bubble triggered by the entrance of a new competitor, the Chinese AI firm DeepSeek.

Robust Sales Performance

In the quarter ending on January 27, Nvidia achieved impressive sales, surpassing $39 billion (£30.7 billion), which represents a remarkable 74% increase compared to the same period last year. This growth highlights the rising demand for Nvidia’s chips, particularly as major technology companies turn to these components to manage the extensive data necessary for training AI models.

Competition from DeepSeek

DeepSeek’s recent entry into the market has raised eyebrows, especially since the company claims to have developed its chatbot using less powerful and cheaper chips. The launch led to a significant drop in Nvidia’s stock earlier this month, impacting the broader market as well. However, investors felt reassured when major companies like Meta (parent company of Facebook) indicated they would maintain their AI investment strategies despite this new competition.

Nvidia’s Market Position

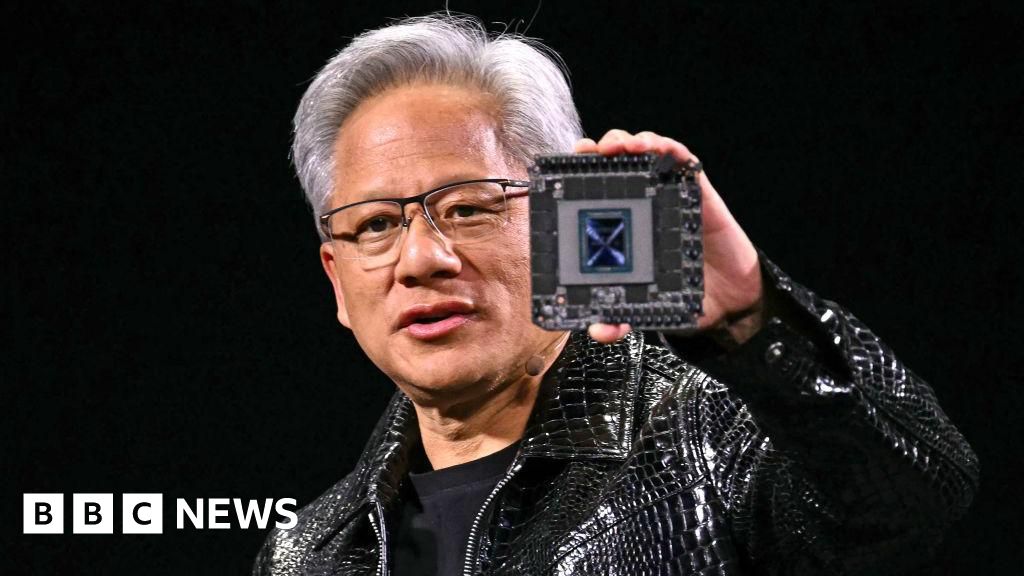

Jensen Huang, Nvidia’s CEO, expressed confidence about the ongoing demand for their products. He noted that the future of software development would largely involve machine learning, which requires chips with different architectures compared to traditional coding practices. Huang emphasized, "We know fundamentally software has changed," reflecting the evolving landscape of AI technology. Furthermore, he stated that it is still "early days" for the widespread adoption of AI.

Nvidia remains a dominant force in advanced chip manufacturing, making it pivotal to the AI investment surge witnessed by major companies, including Microsoft. Over the past two years, Nvidia’s stock has skyrocketed by over 400%, leading to a market valuation exceeding $3 trillion.

Investment in Chip Production

Nvidia is focused on scaling up production of its latest chip series, known as Blackwell, which is a key factor driving their revenue growth. According to Collette Kress, the company’s Chief Financial Officer, the AI data center business is strongest in the United States, but demand is also rising in other regions. For example, increased investments are being seen in France and throughout the European Union.

Challenges in the Chinese Market

Despite strong global demand, Nvidia faces challenges in the Chinese market due to U.S. trade regulations that prohibit the export of certain chips. As a result, the company’s shipments to China have remained lower than expected, and they anticipate shipments will continue at the current levels for the foreseeable future.

Current Landscape of AI Investment

The landscape of AI investment is rapidly changing, and Nvidia is at the forefront of this revolution. With companies keen on enhancing their AI capabilities, the demand for advanced chips like those offered by Nvidia remains robust. The industry is watching closely how new entrants like DeepSeek will impact the competitive dynamics and whether established players like Nvidia can maintain their market dominance amidst emerging technologies and changing consumer needs.