Top 2 AI Stocks to Invest in Before Projected Gains of 39% to 77%

Understanding the Current AI Stock Market Performance

Introduction to AI Stocks in 2025

As we enter 2025, it’s evident that artificial intelligence (AI) stocks are facing challenges in the market. Rising tariffs and increasing economic uncertainties are contributing to a downturn in stock prices for companies in this sector. Notably, two companies often associated with AI advancements, Oracle (NYSE: ORCL) and Confluent (NASDAQ: CFLT), have experienced declines of nearly 20% and over 23% respectively, despite benefiting from the overall growth in AI adoption.

Factors Behind the Stock Decline

Economic Turmoil and Market Sentiment:

- The ongoing tariff-related issues and the looming threat of a U.S. recession have created a negative environment for stocks, impacting even those with strong fundamentals.

- Although both Oracle and Confluent have seen financial upticks due to AI developments, the broader market sentiment is weighing heavily on their stock prices.

- Early-Stage AI Adoption:

- AI adoption is still in its nascent stages, suggesting potential for recovery and growth. Analysts remain optimistic about Oracle and Confluent’s future earnings.

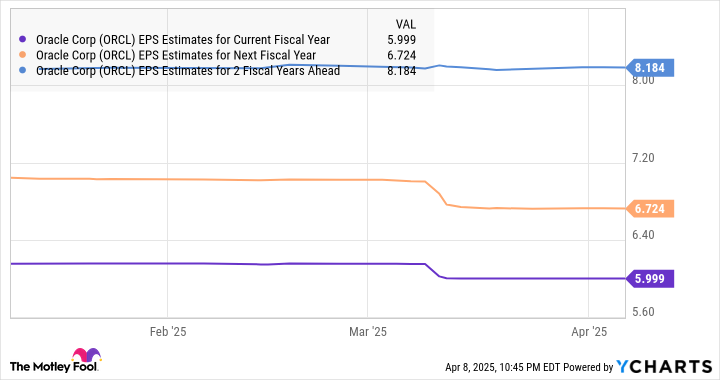

Spotlight on Oracle’s Performance

Growth in Cloud Services

- Oracle has positioned itself as a leader in cloud infrastructure, crucial for AI model training and deployment. Their Q3 fiscal results for 2025 indicated a remarkable 63% increase in contract value, driven primarily by AI-related services.

Key Indicators

Revenue Insight: During an earnings call, Oracle’s management highlighted that the demand level for AI-related cloud services outstripped their current supply capabilities, pushing them to enhance their cloud capacity significantly.

- Future Projections:

- Oracle’s CEO, Safra Catz, stated expectations of doubling their power capacity within the year and tripling it by the end of the next fiscal year, forecasting a 15% revenue increase in fiscal 2026 and 20% in fiscal 2027.

Evaluating Confluent’s Situation

Stock Valuation and Earnings Growth

Confluent’s stock fell sharply from its highs earlier this year, bringing its price-to-sales ratio down to 7.6. This decline has made it appear undervalued, particularly in relation to its earnings growth potential.

- PEG Ratio Analysis: Confluent’s price/earnings-to-growth (PEG) ratio of 0.52 indicates it is undervalued compared to expected growth, making it an attractive prospect for investors focused on future growth.

Role of AI in Revenue Development

Confluent is leveraging AI tools to enhance customer spending significantly. Its cloud-based data streaming service enables clients to access and manage their data in real time, thus improving efficiency.

- The introduction of generative AI features has allowed clients to build robust AI applications like chatbots, driving the company’s dollar-based net retention rate to an impressive 117% in Q4 2024, indicating expansion in existing customer spending.

Investment Insights for Oracle and Confluent

Stock Predictions

Oracle’s stock is currently seen as a compelling buy with a projected price target of $186, suggesting a potential upside of 38.5%.

- For Confluent, analysts see a considerable upside potential with a median price target of $38, reflecting a predicted increase of 76.7%.

Strategic Considerations

- Both Oracle and Confluent present investment opportunities amidst their current stock price drops. With strong fundamentals and strategic growth areas in the AI sector, they could be well-positioned for a solid rebound as the market recovers.

Investors curious about jumping into AI stocks may find that both Oracle and Confluent offer unique opportunities, especially as the integration of AI into various sectors continues to expand. Their current low valuations relative to their growth potential present a compelling case for investment consideration.