Why Analysts Believe Nvidia May Benefit from DeepSeek

Understanding Nvidia’s Recent Stock Performance

Key Takeaways from Recent Developments

- Nvidia’s stock has faced significant post-earnings losses, nearing lows last seen in January following a drop driven by the company DeepSeek.

- Despite these losses, many analysts remain optimistic about Nvidia’s future, citing a surge in demand for artificial intelligence (AI).

- Analysts also expect Nvidia to gain from the growth of DeepSeek and the increased competition in the AI sector.

Recent Stock Trends

Nvidia’s shares have struggled in early 2025, notably dropping by over 8% in one day. Although there was a slight recovery on Friday, the stock remains approximately 7% lower for the week and throughout the year. Investors are navigating a rocky path as they assess the implications of recent developments, particularly concerning DeepSeek, a Chinese AI startup.

Over the past year, Nvidia’s stock price rose significantly, adding roughly half its value. However, DeepSeek’s announcements that its AI models can rival American counterparts at a lower cost have caused concerns about potential declines in demand for Nvidia’s advanced chips.

Analyst Insights

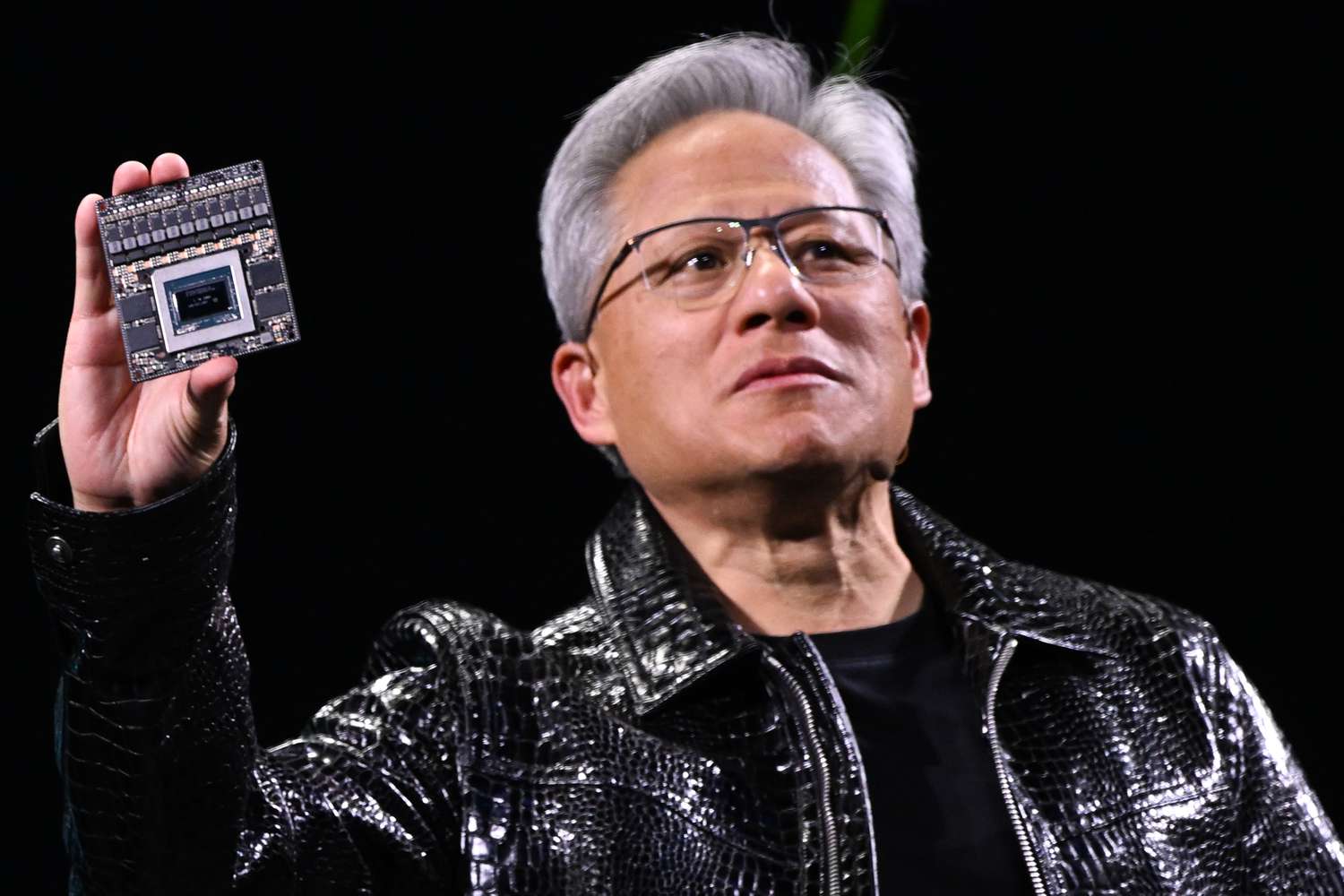

Many analysts have voiced encouragement concerning Nvidia’s prospects, especially highlighted during the company’s recent earnings call. CEO Jensen Huang noted that demand for AI inference is increasing due to the rapid development of new AI models, with special mention of DeepSeek’s innovations.

According to Huang, DeepSeek has sparked a global interest that many AI developers now embrace. He expressed a belief that, rather than reducing the necessity for advanced chips, the rise of next-generation AI will actually require even greater computing power as applications become more intricate. This positions Nvidia well for future growth.

Reactions from Financial Analysts

Following Huang’s statements, analysts from Citi and JPMorgan expressed relief, indicating confidence in Nvidia’s trajectory concerning computing needs as influenced by DeepSeek. Wedbush analysts went further, suggesting that Nvidia is likely to emerge as a significant beneficiary of DeepSeek’s success.

Additionally, analysts at Bank of America pointed out that competition from firms like DeepSeek could motivate American companies to accelerate their AI development efforts, rather than retract their capital investments. In recent earnings calls, numerous large tech clients of Nvidia, including Microsoft, Amazon, Meta, and Alphabet (Google’s parent company), announced plans to increase their capital spending to support their AI endeavors.

The Growing Importance of AI and Nvidia’s Role

Nvidia’s role in the AI sector has become more critical as the industry evolves. The interest in AI technologies is swelling, leading to increasing competition among major players, including DeepSeek. As businesses continue to invest in AI to enhance their operations, the demand for powerful processing chips, like those that Nvidia produces, is likely to persist.

Huang’s assertions serve to underline an anticipated growth trajectory for Nvidia amidst a competitive landscape. While uncertainty hovers due to the recent market behavior and new entrants like DeepSeek, the overall outlook remains promising based on the increasing requirements for advanced computing capabilities in AI development.

Summary of the Current Situation

In summary, Nvidia is navigating a challenging period following a dip in stock prices due to external competition and market adjustments. However, the company’s management expresses a positive outlook, buoyed by ongoing demand for AI advancements. The response from analysts indicates a shared belief in Nvidia’s potential for continued relevance and growth in a rapidly evolving tech landscape driven by artificial intelligence.